Expert Panel: Expect a Buyers Market by 2023

Sky-high mortgage costs are driving down competition among home shoppers, and a market firmly in favor of buyers is expected next year, according to a majority of economists and housing experts polled in the latest Zillow Home Price Expectations Survey (ZHPE). The expert, independent panel also expects rent growth to outpace inflation during the next 12 months, as priced-out potential home buyers exert additional pressure on the rental market.

- Metros in the South and Midwest are the least likely to see price declines over the next year.

- Vacation market areas are most likely to see price declines.

- Rent growth and inflation should outpace stocks and home price appreciation over the next year.

Sky-high mortgage costs are driving down competition among home shoppers, and a market firmly in favor of buyers is expected next year, according to a majority of economists and housing experts polled in the latest Zillow Home Price Expectations Survey (ZHPE).[1] The expert, independent panel also expects rent growth to outpace inflation during the next 12 months, as priced-out potential home buyers exert additional pressure on the rental market.

Home value growth, which hit record highs over the course of the pandemic, is now slowing as affordability challenges — magnified by quickly rising mortgage rates — are pushing many prospective buyers to the sidelines. Typical home values are ticking down slightly across the U.S. and declining more steeply in some of the most expensive metros, as well as those that grew the fastest over the past two years.

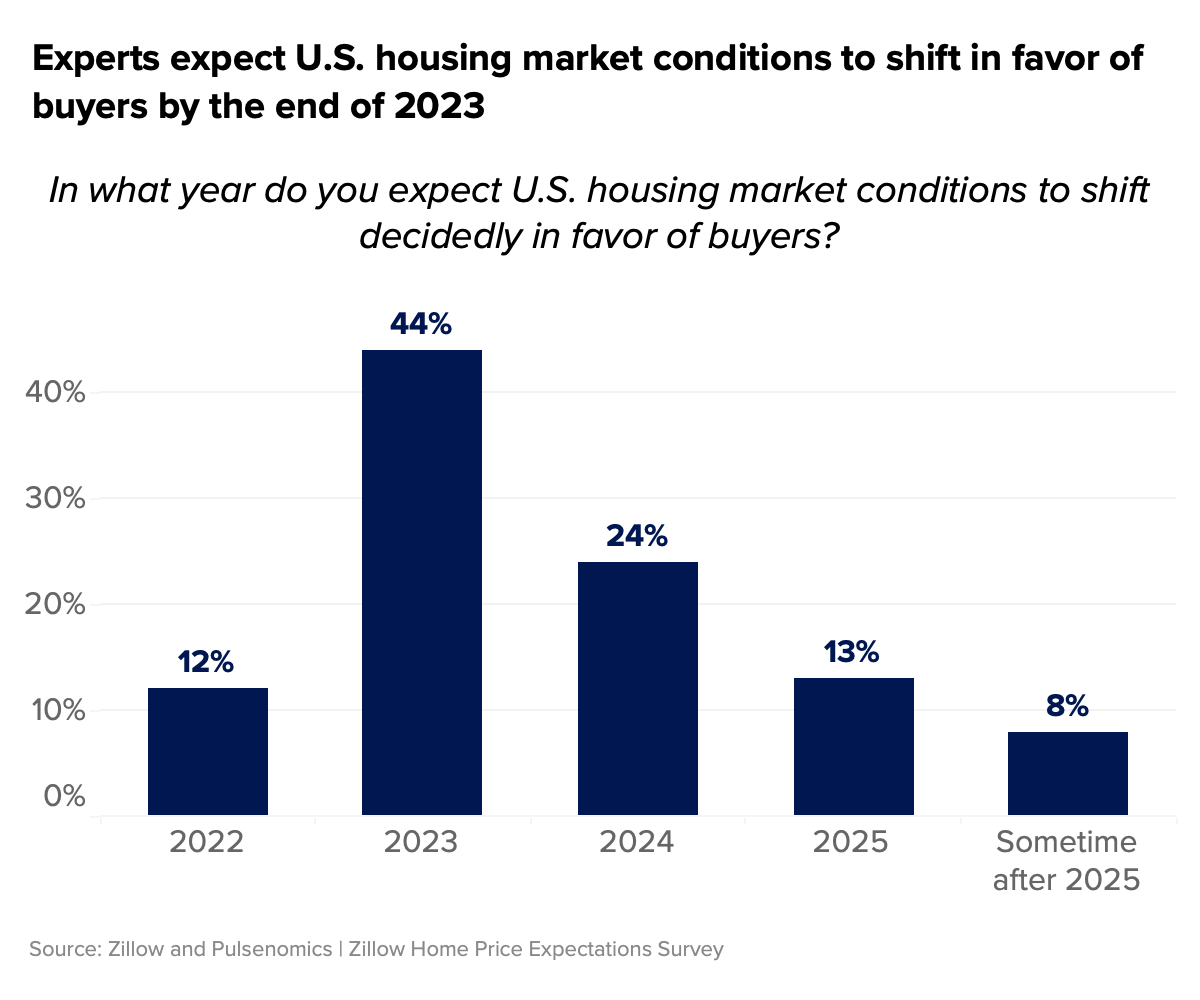

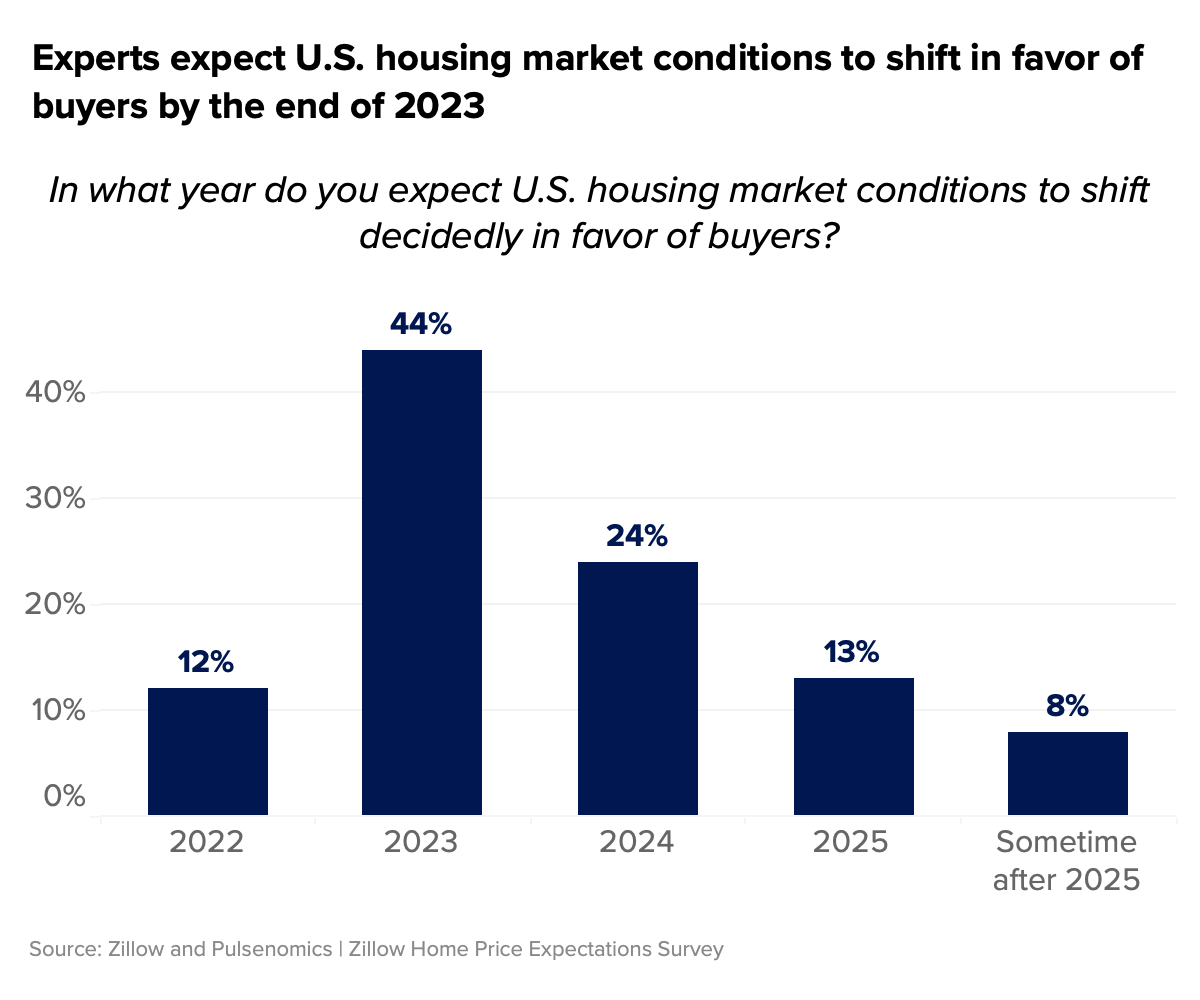

Although home price growth has slowed, the market is far from pre-pandemic norms. Zillow’s latest market report showed listings’ typical time on market, while rising, is still 11 days shorter than in 2019. Inventory is ticking up as well, but is still down almost 42% compared to 2019. The majority of the panel (56%) expects a significant shift in buyers’ favor by sometime next year. Another 24% predicted that shift would come in 2024, 13% pointed to 2025, and just 8% expect it after 2025.

After the frantic rush for real estate over the past two years, prospective buyers are finally seeing a calmer market. Those still able to afford home ownership are quickly regaining lost leverage, but this shift to a more balanced market is still in its early stages. Home shoppers priced out of the market face further hurdles though, as high and rising rents could cut further into their ability to save up for a down payment.

Although the panel-wide 2022 expected home price appreciation rate ticked up to 9.8% from 9.3% in this most recent survey, all 107 survey respondents project home price deceleration in 2023. The share of panelists who believe their long-term outlook might be too optimistic jumped up to 67% from 56% last quarter.

Inexpensive Midwest markets — such as Columbus, Indianapolis and Minneapolis — are the least likely to see home prices decline over the next 12 months, according to survey respondents, of which just 36% reported that home price declines from current levels were likely over the next 12 months. Fast-growing markets in the South, such as Atlanta, Nashville and Charlotte, are also expected to retain their heat by a majority of panelists, with 44% of respondents indicating declines were likely.

Markets projected to cool the fastest — with 77% of respondents expecting declines — are those that saw some of the largest growth over the course of the pandemic, including Boise, Austin and Raleigh.

Suburban and exurban areas are predicted by the panel to retain their heat over the next 12 months, while vacation areas and urban areas were considered the most likely to see price declines.

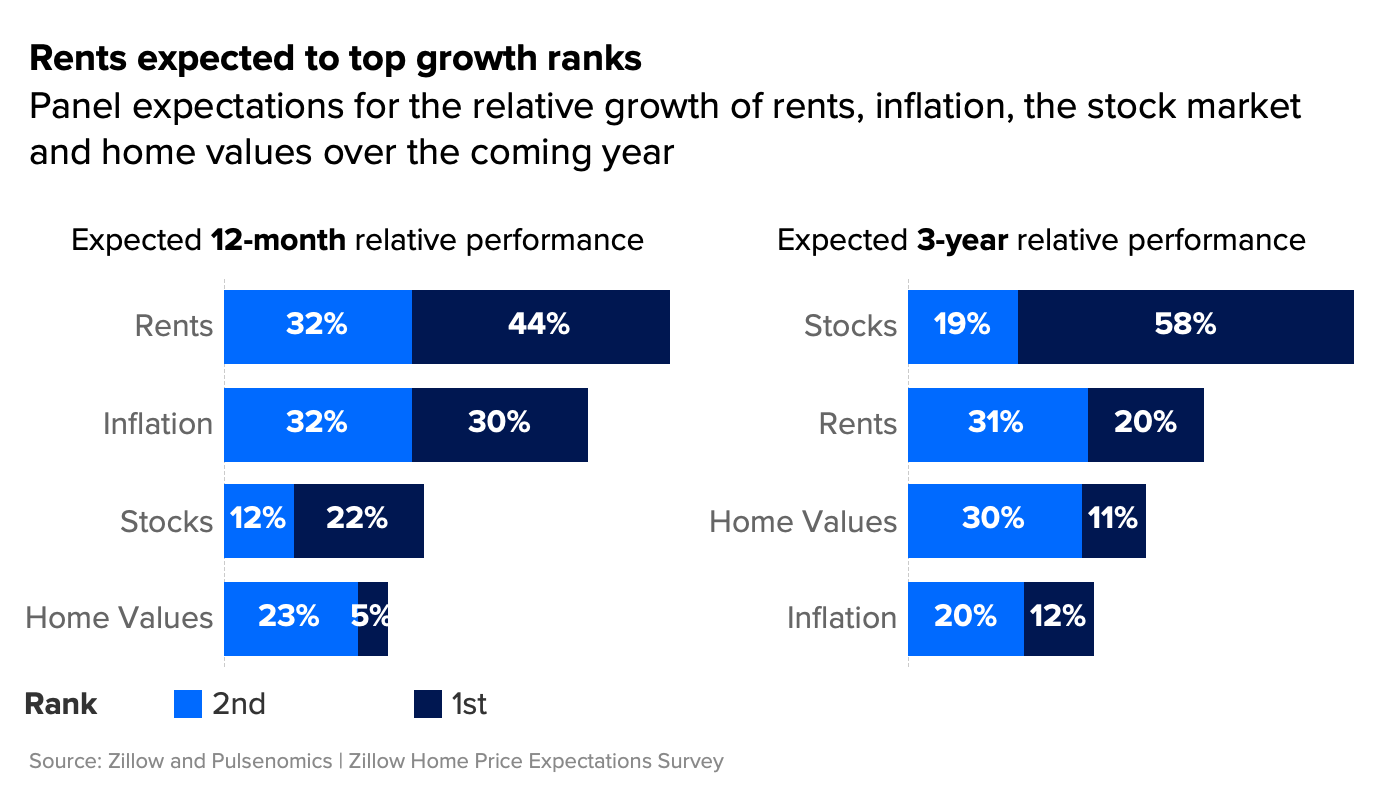

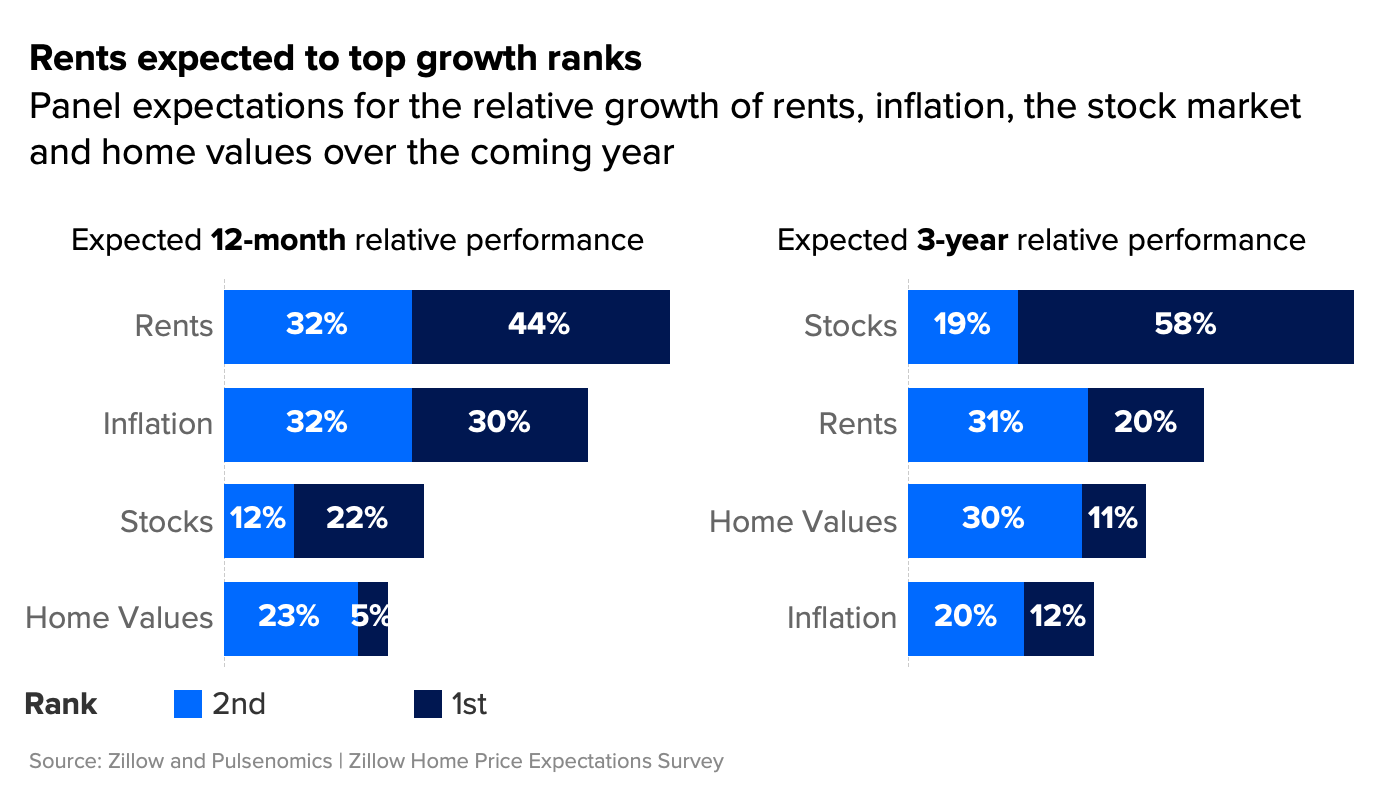

Rents expected to top growth ranks

The panel also gave their expectations for the relative growth of rents, inflation, stocks and home values over the coming year.

Rent growth should remain strong in the short term as high home prices keep many would-be first-time buyers in the rental market. Over the next 12 months, rents are expected to grow more than inflation, stocks and home values.

The panelists predict an average of 5.4% rent growth throughout 2023 – lower than the 8.6% annual growth they expect to see by the end of this year, but still higher than what Zillow data show to be just under 4% annual growth in the years prior to the pandemic.

This demand for rentals has already spawned new supply in the pipeline. Builders responded to declining home purchases by ramping up construction on multifamily units, bringing starts to their highest level in years. The panel projects stock prices will rebound over the next three years, outpacing growth in home prices and rents as overall inflation cools.

[1] This edition of the Zillow Home Price Expectations Survey surveyed 107 housing market experts and economists August 16–-27, 2022. The survey was conducted by Pulsenomics LLC on behalf of Zillow, Inc. The Zillow Home Price Expectations Survey and any related materials are available through Zillow and Pulsenomics.