Get home on your budget with Zillow Home Loans

Start your home buying journey with confidence by getting pre-qualified with Zillow Home Loans.

- No impact to your credit

- No hidden fees

- Pre-qualify in as little as 3 minutes

Why Zillow Home Loans?

Getting home is a journey. Our loan officers are here to help you stay on budget and on schedule.

Top-rated loan officers

With a 4.8-star average rating, our loan officers provide step-by-step guidance and expertise in first-time home buying.

Competitive rates

Strong rates, no hidden fees and total transparency to keep you informed

and up-to-date.

Low down payment options

We offer a variety of loan options to meet your needs and help make home ownership more affordable.

We'll meet you wherever you are

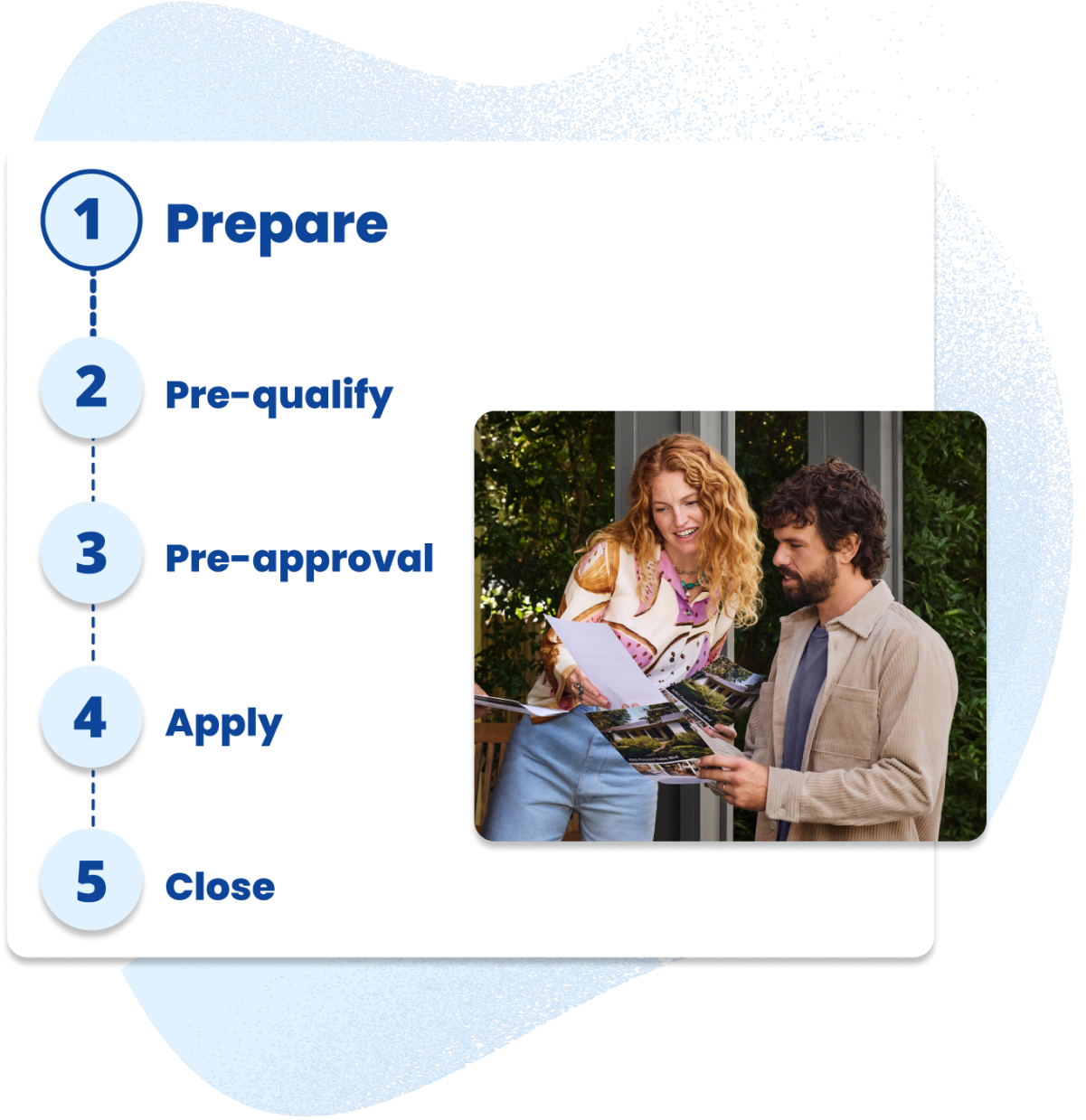

How to finance with Zillow Home Loans

Not sure where to begin on your home buying journey? Here's a quick guide to help you get started.

- 1. Prepare your finances

Take some time to review your credit score and income. Avoid taking out loans, opening credit cards or making large purchases for six months. Then, get a quick estimate of what you can afford with our Affordability Calculator.

- 2. Get pre-qualified

Get an estimate for the amount you'll be able to borrow, so you can confidently search for homes within your budget. With Zillow Home Loans, you can get pre-qualified in as little as three minutes with no impact to your credit score.

- 3. Get a verified pre-approval

Getting pre-approved by a lender helps you make a strong and competitive offer. A loan officer will verify your income and assets, so you'll want to prepare documents such as pay stubs, W-2's and bank statements.

- 4. Apply for a mortgage

After the seller accepts your offer, it's time to begin the formal mortgage application for your new home. Our loan officers will be available to provide expert guidance for your unique situation, every step of the way.

- 5. Close on your new home

In most states, you'll close your loan with an escrow company. Once your loan is approved, the lender sets a date to finalize the sale and check your credit one last time.

Have more questions about financing?

Get pre-qualified and speak with a licensed loan officer or see the full list of financing steps in our article about the mortgage application process.

Take the next step with an Affordability Calculator

Calculate your budget

Deciding how much you can comfortably spend on a home will help you prepare for your search.

Explore our variety of loan options

Conventional loan

Wide range of options to suit many unique needs.

3%

min. down payment.

Loan highlights:

- Fixed-rate options

- 15-, 20-, or 30-year terms offered

- PMI required with <20% down

FHA loan

Wide range of options to suit many unique needs.

3.5%

min. down payment.

Loan highlights:

- Popular with first-time buyers

- Flexible credit requirements

- Mortgage insurance is required

VA loan

Wide range of options to suit many unique needs.

0%

min. down payment.

Loan highlights:

- Competitive interest rates

- Reduced closing costs

- No PMI

Rate and term refinance

Adjust your loan terms

- Remove PMI

- Shorten or extend how long you'll pay on your home

- Fixed and adjustable rate options available

Streamline refinance

No credit check or appraisal

- Less hassle than traditional refinance processes

- Existing government-backed mortgage required

Cash-out refinance

Get cash and a new home loan

- Get up to 80% of home's value

- Use your cash however you'd like

- Conventional and government-backed options available

See what our customers are saying

Your homeownership journey starts here.

Understand what you qualify for and shop with confidence by getting pre-qualified.